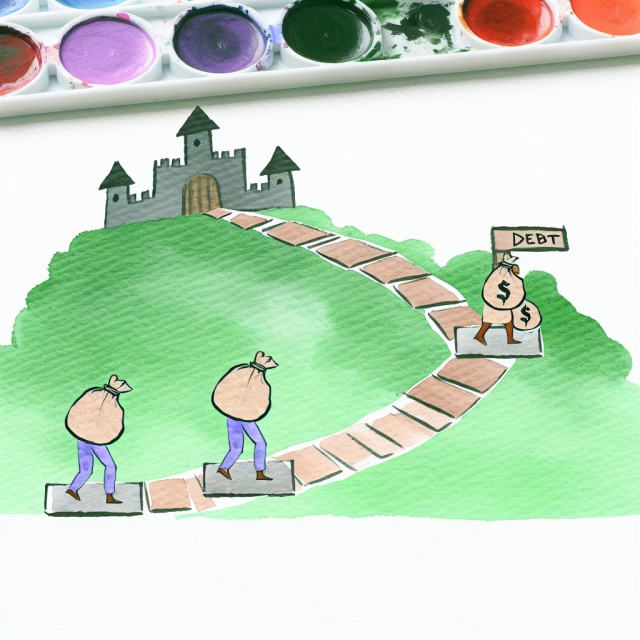

Understanding how to effectively manage and prioritize debt repayment is a critical aspect of financial planning that can significantly impact one’s financial well-being. With the increasing cost of living and the ease of access to credit, many individuals find themselves juggling various types of debt. From student loans to credit cards and mortgages, managing these obligations in a way that fits within a sustainable financial plan is vital. Prioritizing debt repayment is not just about ensuring payments are made on time. It’s about strategizing to reduce debt amounts faster and more efficiently, ultimately leading to financial freedom.

The importance of prioritizing debt repayment within financial planning cannot be understated. Effective debt management not only helps in reducing financial stress but also improves credit scores, which can be critical for future financial opportunities. A well-structured debt repayment plan forms an integral part of long-term financial planning and stability, ensuring that individuals can allocate more of their financial resources towards savings and investments rather than servicing debt obligations.

Crafting a financial plan that includes debt repayment involves understanding the nuances of different debts, their terms, and their impact on overall financial health. It requires a systematic approach to assess current debt situations, identify which debts should be prioritized based on factors like interest rates, and incorporate an action plan into regular financial reviews. Consistent monitoring and adjustment of this plan ensure that it remains aligned with changing financial circumstances and goals.

Over the course of this guide, we’ll explore various debt repayment strategies, elucidate the benefits of prioritizing certain types of debt over others, and provide actionable steps for incorporating these strategies into one’s broader financial plan. We’ll also discuss the role of professional advice and the long-term benefits that arise from good debt management practices. By the end of this guide, readers should have a comprehensive understanding of how to approach debt repayment effectively.

Understanding the Importance of Debt Repayment in Financial Planning

Debt repayment is a cornerstone of effective financial planning for several reasons. It directly affects a person’s disposable income and, by extension, their quality of life. When debts are mismanaged, they can lead to financial distress, limiting the ability to save or invest in the future. The quicker debts are paid off, the sooner you can redirect funds to other financial goals, such as retirement savings, purchasing a home, or investing in education or other wealth-building opportunities.

Additionally, timely debt repayment is crucial for maintaining a healthy credit score. A good credit score opens up a multitude of financial options, such as favorable interest rates on loans and better credit card deals, which can save you thousands over your lifetime. Conversely, missed payments or high levels of outstanding debt can mar a credit report, making future borrowing difficult and expensive.

Lastly, understanding debt repayment as part of a larger financial plan is crucial for setting priorities. Not all debts are created equal; the type of debt and its terms can have varying implications for your financial health. A strategic approach allows you to focus on paying off high-interest debts first, reducing the overall amount paid over time, and improving your financial situation progressively.

Assessing Your Current Debt Situation

Before embarking on a debt repayment journey, it’s vital to understand your current debt landscape completely. Begin by listing all obligations, including credit cards, student loans, mortgages, and any personal loans. Include the outstanding balance, minimum monthly payments, interest rates, and due dates for each debt. This comprehensive view will help you identify which debts are costing you the most and require urgent attention.

It’s also beneficial to categorize these debts into secured and unsecured types. Secured debts are those backed by an asset, like a mortgage, where failure to pay can result in the loss of the asset. Unsecured debts, like credit cards, do not have collateral attached but tend to have higher interest rates. Understanding these categories helps in risk assessment and prioritizing repayments.

Consider the impact of your current debt on your monthly budget. Calculate what percentage of your income goes toward servicing these debts to assess whether you’re within a manageable debt-to-income ratio. If a substantial portion of your income is going towards debt repayments, it may be time to consider structural changes in your financial habits or explore debt relief options.

Identifying High-Interest vs. Low-Interest Debts

Once you have a clear picture of your debts, the next step is to differentiate between high-interest and low-interest obligations. High-interest debts, such as credit cards and some personal loans, accumulate interest quickly, which can significantly increase your total repayment amount over time if not prioritized. Low-interest debts, on the other hand, usually include mortgages and student loans, which can be more manageable in terms of interest accrual.

Identifying these differences allows for strategic planning where the focus is to minimize the interest paid over the life of the debt. High-interest debt costs you more in the long run, so channeling extra payments toward these can save significant money. Prioritizing high-interest debts can shorten the timeline for becoming debt-free and improve financial flexibility faster.

Understanding your high-interest versus low-interest debts also helps in selecting the appropriate repayment method, such as the Avalanche or the Snowball method, which we will discuss later. Consider creating a table to visualize your debts to further clarify which debts should be prioritized first:

| Debt Type | Balance | Interest Rate | Priority |

|---|---|---|---|

| Credit Card 1 | $5,000 | 20% | High |

| Student Loan | $15,000 | 5% | Low |

| Car Loan | $10,000 | 7% | Medium |

| Personal Loan | $2,000 | 15% | High |

Creating a Budget to Identify Available Funds for Debt Repayment

Crafting a budget is a fundamental step in identifying available funds for debt repayment. Start by tracking your income and expenses over several months to get an accurate picture of your financial situation. Categorize your expenses into fixed costs (like rent and utilities) and variable costs (such as entertainment and dining out). This will help you determine where cuts can be made to free up funds for debt payments.

Once your income and expenses are clearly outlined, identify areas where spending can be reduced. This might include dining less frequently at restaurants, canceling unused subscriptions, or finding more cost-effective transportation options. The money saved should then be directly allocated to debt repayment efforts, allowing you to make substantial progress on your debt faster.

Incorporate this revised budget into your broader financial plan, ensuring that it is both realistic and sustainable. The aim is to commit a consistent amount toward debt reduction each month, alongside maintaining living expenses and setting aside emergency funds. This balanced approach will prevent burnout and ensure financial stability even as you work towards debt freedom.

Exploring Different Debt Repayment Strategies

There are several strategies to consider when tackling debt, each suitable for different financial situations. Here are a few popular ones to consider:

-

Debt Snowball Method: Focus on paying off the smallest debt first while making minimum payments on larger debts. This helps build momentum and morale as debts are eliminated.

-

Debt Avalanche Method: Prioritize debts with the highest interest rate first to save money on interest over time.

-

Consolidation Loans: Combining all your debts into a single loan with a lower interest rate can simplify payments and reduce interest costs.

-

Balance Transfer Offers: Some credit cards offer low interest or zero interest on balance transfers for a limited time, allowing you to focus on principal repayment without accruing interest.

-

Negotiating with Creditors: Contact lenders to negotiate lower interest rates or adjusted payment plans based on financial hardship.

These strategies can be fine-tuned to align with your goals, needs, and financial capabilities. It’s crucial to weigh the advantages and disadvantages of each method alongside your personality and financial disposition to find the best fit.

The Debt Avalanche vs. Debt Snowball Methods

The Debt Avalanche vs. Debt Snowball Methods is a popular subject among financial planners, as each method offers distinct psychological and financial benefits.

Debt Avalanche Method

The Debt Avalanche method targets the most expensive debts first—that is, those with the highest interest rates. By paying off high-interest loans, borrowers reduce the total amount of interest they will need to pay over the life of all their debts. This scientific approach, focused on minimizing costs, often leads to quicker financial relief in terms of interest paid over time.

Debt Snowball Method

Alternatively, the Debt Snowball method focuses on settling the smallest debts first, which can be deeply motivational. As smaller debts are paid off, borrowers experience a sense of accomplishment, which can promote persistence and discipline. This method is excellent for those who might find motivation and immediate results beneficial in their debt repayment strategy.

Choosing between these methods depends on an individual’s financial situation and personal preferences. Some may opt for the objective savings associated with the Avalanche method, while others may find the emotional benefits of the Snowball method more compelling.

Setting Clear and Achievable Debt Repayment Goals

Establishing clear, achievable goals is paramount to a successful debt repayment journey. Begin by setting a target date for becoming debt-free, ensuring that this timeline is realistic based on your current financial situation. Use this target date to calculate the monthly payments required to meet this objective.

Goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, setting a goal to pay off $10,000 in credit card debt over two years involves allocating funds, adjusting budgets, and possibly consolidating debts for lower interest rates. Breaking the goal into monthly or quarterly objectives ensures steady progress and creates a roadmap for financial planning.

Additionally, celebrate milestones along the way to maintain motivation. Each paid-off loan or debt reduction deserves recognition, reinforcing positive financial habits and propelling you toward your next financial goal.

Incorporating Debt Repayment into Your Monthly Financial Plan

Debt repayment should be seamlessly integrated into your monthly financial plan, harmonizing with all other financial objectives and responsibilities. Start by automating payments to ensure they’re prioritized and to prevent late fees and interest rate hikes. Automation also aids in maintaining consistency, a key factor in successful debt management.

Allocate specific funds each month toward debt repayment before other discretionary expenses. By treating debt payments as a mandatory expense, like rent or utilities, you’ll ensure they remain a priority in your financial plan. Tools like budgeting apps can help track expenses, remind you of payments, and provide an overview of your progress.

Remember, an effective monthly financial plan is dynamic. It must adapt to changes in income or unexpected expenses while keeping you on track to meet your debt repayment and overall financial goals.

Monitoring Your Progress and Adjusting Your Strategy if Needed

Regularly monitoring your debt repayment progress ensures that you are on track to meet your goals. Review your budget and payment schedule monthly to verify that your contributions align with your original plan and adjust as necessary. If your financial situation improves, consider increasing your monthly debt repayments to expedite the process.

Should unexpected expenses arise or income decrease, be prepared to alter your repayment plan accordingly. Temporary setbacks need not derail your overall strategy. Instead, re-evaluate your budget, adjust your goals, and devise a practical course of action. Flexibility is crucial in managing debt, as rigid plans may break under unforeseen financial pressures.

Consider the use of financial management tools to track your progress, as these can offer insights and visual representations of your debt repayment journey. This data can be incredibly motivating, helping you visualize how far you’ve come and how close you are to achieving financial freedom.

Considering Professional Financial Advice for Complex Situations

Sometimes, navigating multiple debts and repayment strategies can become overwhelming, and professional financial advice might be needed. Financial advisors offer expertise in creating tailored debt management plans, providing insights based on unique financial scenarios. They can also introduce you to products or agreements you might not have considered, like debt consolidation loans or targeted investment strategies alongside debt repayment plans.

Look for advisors certified by organizations such as the CFP Board, which ensures they have met comprehensive planning and ethical standards. An advisor can assess your overall financial health, helping integrate debt repayment with broader financial goals such as saving for a house or retirement.

Moreover, if considering bankruptcy or feeling trapped under insurmountable debt, a professional’s guidance can be invaluable. They can help navigate legal options and negotiate with creditors to create a feasible repayment arrangement conducive to long-term financial health.

The Long-Term Benefits of Prioritizing Debt Repayment in Financial Stability

Prioritizing debt repayment has numerous long-term benefits that extend beyond the immediate relief of financial pressure. Achieving debt freedom enhances disposable income as money previously earmarked for debt repayments can now be directed towards savings and investments. This shift allows for the accumulation of wealth, bettering financial security.

Improved credit scores from consistent debt repayment increase access to credit at favorable terms, such as lower interest rates and more significant borrowing capacity. This can be crucial when pursuing major life goals like buying a home or financing a child’s education. Moreover, the discipline required to manage debt effectively translates into better overall financial habits, aiding with other monetary responsibilities.

Lastly, the peace of mind achieved from eliminating debt contributes to overall well-being. Financial Freedoms create opportunities, providing the comfort of knowing that financial crises are less likely, enabling a more comfortable and secure lifestyle.

Conclusion

Prioritizing debt repayment within your financial plan is not just a one-time task but an ongoing process that demands attention and commitment. Understanding the importance of debt repayment is the first step towards managing your financial health effectively. With a clear assessment of your current debt situation and a strategy to address high-interest debts first, you are better equipped to start reducing your financial liabilities and improve your overall creditworthiness.

Creating an actionable budget and selecting suitable debt repayment methods, such as the Avalanche or Snowball strategies, are critical components of a successful financial plan. These steps should seamlessly integrate with your monthly financial routines, allowing you to maintain stability even as you aggressively tackle your debts. Throughout this process, flexibility is vital—adjust strategies as needed based on changing financial circumstances to ensure continual progress toward your goals.

In the long run, prioritizing debt repayment yields career-defining benefits. From an enhanced credit score to more free cash for investments and life goals, the rewards of managing debt wisely extend across your financial life. Combined with professional financial advice when necessary, a commitment to repaying debt can create a stable foundation for all future financial planning efforts.

Recap

- The significance of debt repayment in financial planning is rooted in immediate and long-term financial health.

- Assessing your current debt situation helps to identify priorities.

- Prioritization of high-interest debts can save money and accelerate financial freedom.

- Developing a strategic budget supports focused and consistent debt repayment.

- Different repayment strategies, including the Debt Avalanche and Snowball, offer varied benefits depending on personal financial situations.

FAQ

1. Why is debt repayment important in financial planning?

Debt repayment is crucial because it affects credit scores, financial flexibility, and long-term financial health. Reduced debt allows for increased savings and investment opportunities.

2. What’s the difference between high-interest and low-interest debts?

High-interest debts accrue interest at a faster rate and increase the overall repayment amount, while low-interest debts cost less over time.

3. How should I start assessing my debt situation?

List all debts, including details like balances, interest rates, and minimum payments to understand where to focus your repayment efforts.

4. What’s the best way to prioritize my debts?

Focus on high-interest debts first, as they accumulate costs more quickly, or use the Snowball method for psychological momentum.

5. How can budgeting help in debt repayment?

A budget helps identify and allocate discretionary income toward debt repayment, ensuring consistent and effective payment efforts.

6. What’s the difference between the Debt Avalanche and Debt Snowball methods?

The Avalanche method targets high-interest debts first to minimize costs, while the Snowball method addresses smaller debts first for motivational benefits.

7. When should I consider professional financial advice for debt repayment?

If overwhelmed by debt or facing significant financial decisions like bankruptcy, seek a financial advisor for guidance and solutions.

8. What are the benefits of integrating debt repayment into my monthly plan?

It ensures repayment efforts remain consistent, aligns with broader financial goals, and prevents debt from derailing financial stability.

References

- Debt Snowball vs. Debt Avalanche: What’s the Best Method?

- Consumer Financial Protection Bureau on Debt Collection

- Investopedia: Debt Consolidation vs. Refinancing