Introduction: Understanding Financial Boundaries

Financial boundaries refer to the limits and guidelines one sets regarding financial matters in both personal and professional settings. These boundaries can include decisions about how much to save, how much to spend, and even how to share or discuss finances with others. Setting these boundaries involves being clear about one’s financial goals, limits, and expectations, which serves to protect one’s financial health and overall well-being.

While many people tend to focus on the importance of establishing boundaries in relationships and personal space, financial boundaries are often overlooked. Ignoring these boundaries can lead to significant stress and misunderstandings in both personal and professional spheres. A well-defined financial boundary helps individuals maintain control over their finances, fostering a sense of security and stability.

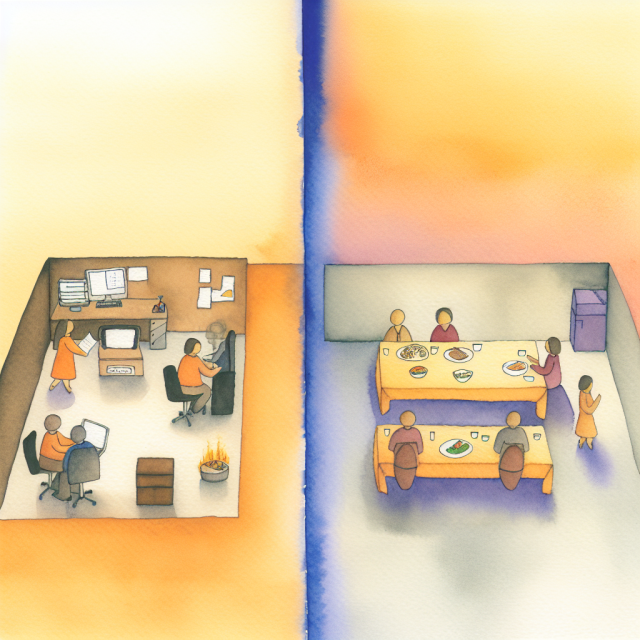

Moreover, financial boundaries are not just limited to personal life; they play a crucial role in professional settings as well. Understanding where to draw the line in terms of spending for business purposes, how to handle salary negotiations, and separating personal expenses from business expenses is essential for professional success. These boundaries ensure that one does not overextend themselves financially or become entangled in complex financial issues that could harm their career.

In essence, financial boundaries act as a form of self-care, safeguarding one’s financial health and preventing potential financial crises. By taking the time to establish and respect these boundaries, individuals are better equipped to manage their finances effectively, thus promoting long-term financial stability and success.

Why Financial Boundaries Matter

The importance of financial boundaries cannot be overstated. They serve as a roadmap for how individuals manage their finances, preventing financial stress and conflicts. Without clear financial boundaries, people often find themselves in situations where they overspend, take on unnecessary debt, or face disputes with others over money.

Firstly, financial boundaries help in maintaining a balanced and healthy financial life. They enable individuals to set priorities, ensuring that essential expenses are covered before non-essential ones. This aids in building a robust financial foundation, making it possible to save for future goals such as buying a home, retirement, or even a vacation.

Secondly, financial boundaries enhance relationships by reducing conflicts related to money. When individuals are clear about their financial limits and communicate them effectively, it helps in managing expectations. This clarity is vital in relationships, be it with a partner, family member, or friend, as it prevents misunderstandings and ensures that financial responsibilities are fairly divided.

Lastly, in a professional context, financial boundaries are crucial for ethical and responsible financial management. They help in delineating personal and business expenses, ensuring that employees and employers adhere to specified budgets and financial protocols. This also aids in maintaining transparency and trust within an organization, fostering a healthy work environment.

Common Financial Boundaries in Personal Life

Establishing financial boundaries in personal life is essential for maintaining financial health and harmony in relationships. Several common financial boundaries can help individuals manage their personal finances effectively.

One key boundary is budgeting. Creating and adhering to a budget allows individuals to allocate their income towards necessary expenses, savings, and discretionary spending. This can prevent overspending and help in achieving long-term financial goals.

Another important financial boundary is setting limits on lending and borrowing money within personal relationships. While it can be tempting to lend money to friends or family in need, establishing clear rules about how much can be lent and under what conditions can prevent financial strain and preserve relationships.

Lastly, it’s crucial to have clear boundaries around spending on non-essential items. Impulse purchases and emotional spending can quickly derail financial plans. Having a set limit on discretionary spending ensures that essential financial commitments are met first, and helps in building savings for future needs.

| Financial Boundary | Description |

|---|---|

| Budgeting | Allocation of income towards necessities, savings, and discretionary spending |

| Lending/Borrowing | Setting limits and conditions on lending money to friends and family |

| Discretionary Spending | Establishing spending limits on non-essential items to prevent impulse purchases |

Setting Financial Boundaries in Relationships

Setting financial boundaries in relationships is critical for ensuring mutual understanding and respect when it comes to money matters. Whether in a romantic relationship, a friendship, or a family dynamic, clear financial boundaries can prevent conflicts and build financial harmony.

In romantic relationships, discussing finances openly and honestly is essential. Couples should talk about their individual financial goals, spending habits, debts, and income. This discussion helps in setting joint financial goals and creating a shared budget, ensuring that both partners are on the same page.

In friendships, financial boundaries are equally important. It’s common for friends to spend money on outings and gifts, but it’s vital to set limits on these expenditures to avoid financial strain. Communicating these boundaries can prevent misunderstandings and ensure that both parties feel comfortable in the financial aspects of their friendship.

With family members, setting financial boundaries can sometimes be more challenging due to emotional ties. However, it’s necessary to establish clear rules around lending or borrowing money, financial support, and shared expenses. This clarity prevents financial stress and ensures that family relationships remain healthy and supportive.

Establishing Financial Limits in Professional Settings

In a professional setting, financial boundaries are essential for the health of both employees and organizations. These boundaries ensure that financial transactions are conducted ethically and responsibly, protecting the financial interests of all parties involved.

A common financial boundary in the workplace is the separation of personal and business expenses. Employees should be clear about what constitutes a business expense and what should be covered personally. This distinction helps in maintaining transparency and avoiding potential conflicts of interest.

Another critical financial boundary in professional settings is adhering to budgets. Whether it’s a departmental budget or a project-specific one, sticking to the allocated budget ensures that resources are used efficiently and effectively. It also helps in preventing financial mismanagement and ensures the sustainability of business operations.

Salary negotiations are another area where financial boundaries are vital. Employees should have a clear understanding of their worth and set boundaries on the minimum salary they are willing to accept. This not only ensures fair compensation but also helps in maintaining employee morale and satisfaction.

The Role of Financial Boundaries in Preventing Debt

Financial boundaries play a significant role in preventing debt and promoting financial stability. By establishing and adhering to these boundaries, individuals can avoid taking on unnecessary debt and manage their finances more effectively.

One way financial boundaries help in preventing debt is through budgeting. A well-structured budget ensures that income is allocated toward essential expenses first, with a portion set aside for savings. This prevents overspending and ensures that there is a cushion for unexpected expenses, reducing the need to rely on credit.

Setting limits on discretionary spending is another way financial boundaries can prevent debt. By establishing a cap on non-essential purchases, individuals can avoid impulse buying and unnecessary expenditures, keeping their financial health in check.

Lastly, financial boundaries around borrowing are crucial in debt prevention. Individuals should be clear about the conditions under which they will borrow money, whether it’s taking out a loan or using a credit card. This clarity prevents taking on more debt than one can manage and ensures that any borrowed money is used responsibly.

| Financial Boundary | Role in Debt Prevention |

|---|---|

| Budgeting | Ensures essential expenses are met first and builds a savings cushion |

| Discretionary Spending | Prevents impulse purchases and unnecessary expenditures |

| Borrowing Limits | Ensures responsible borrowing and prevents excessive debt |

Tips for Communicating Financial Boundaries

Effective communication is key to setting and maintaining financial boundaries. Clearly articulating one’s financial limits and expectations can prevent misunderstandings and conflicts, both in personal and professional settings.

One of the first tips for communicating financial boundaries is to be honest and transparent. Whether it’s with a partner, friend, family member, or colleague, being open about financial goals, limitations, and needs helps in creating a mutual understanding. This honest dialogue fosters trust and ensures that all parties are on the same page.

Another important tip is to use “I” statements when discussing financial boundaries. For example, instead of saying “You spend too much money,” one could say, “I feel uncomfortable with our current spending habits.” This approach focuses on one’s own feelings and experiences, making the conversation less accusatory and more constructive.

It is also beneficial to set specific and clear boundaries. Vague statements like “I don’t want to spend too much” can be confusing. Instead, being specific about limits, such as “I can only afford to spend $50 on this outing,” provides clarity and helps in respecting those boundaries.

How to Enforce Financial Boundaries Consistently

Enforcing financial boundaries consistently is just as important as setting them. Without consistent enforcement, even the most well-defined financial boundaries can lose their effectiveness and lead to financial stress.

One way to enforce financial boundaries consistently is through regular monitoring. Keeping track of spending and budgets helps in ensuring that one is adhering to their financial limits. This can be done through various tools such as budgeting apps, spreadsheets, or even a simple notebook.

Another method is to have regular financial check-ins with those involved. For example, couples can have monthly budget meetings to review their finances and ensure they are sticking to their financial goals. Similarly, in professional settings, regular financial reviews can help in maintaining adherence to budgets and financial protocols.

Lastly, it’s essential to stick to the consequences of breaching financial boundaries. If a boundary is crossed, it’s important to address it and take the necessary actions to rectify the situation. This enforcement reinforces the importance of the boundary and helps in preventing future breaches.

Overcoming Challenges in Maintaining Financial Boundaries

Maintaining financial boundaries can sometimes be challenging, especially in the face of unexpected expenses, societal pressures, or emotional ties. However, overcoming these challenges is crucial for long-term financial health.

One common challenge is the temptation to overspend in social situations. To overcome this, individuals can plan ahead and set specific spending limits for social activities. Communicating these limits to friends or family can also help in managing expectations and reducing pressure to overspend.

Another challenge is handling unexpected expenses. While it’s impossible to predict every financial emergency, having an emergency fund can provide a buffer and help in maintaining financial boundaries. Regular contributions to this fund can ensure that there are resources available when needed, preventing the need to dip into other funds or take on debt.

Emotional relationships can also pose a challenge to financial boundaries, as it’s often hard to say no to loved ones. In such cases, it’s important to have open and honest conversations about financial limitations and stick to them. Seeking support from a financial advisor or counselor can also provide guidance in navigating these difficult situations.

Long-Term Benefits of Setting Financial Boundaries

Setting financial boundaries offers numerous long-term benefits that contribute to overall financial health and well-being. These benefits extend beyond immediate financial stability and contribute to a secure financial future.

One significant long-term benefit is the accumulation of savings. By adhering to financial boundaries, individuals can consistently save a portion of their income, building a financial cushion for future needs and goals. This can include retirement savings, investments, emergency funds, or saving for major life events such as buying a home or education.

Another long-term benefit is the reduction of financial stress. Clear financial boundaries prevent overspending and debt, which are common sources of stress. With reduced financial strain, individuals can enjoy a better quality of life and focus on other important aspects of their well-being.

Additionally, setting financial boundaries promotes responsible financial behavior and discipline. This discipline can lead to better financial decision-making in the long run, ensuring that individuals can navigate financial challenges effectively and make the most of their financial resources.

| Long-Term Benefit | Description |

|---|---|

| Accumulation of Savings | Building a financial cushion for future needs |

| Reduction of Financial Stress | Preventing overspending and debt |

| Promotion of Financial Discipline | Encouraging responsible financial behavior |

Conclusion: Building a Balanced Financial Future

In conclusion, setting financial boundaries is a crucial aspect of maintaining financial health and achieving long-term financial stability. Whether in personal or professional settings, these boundaries serve as guidelines that help manage finances effectively, prevent financial stress, and foster healthy financial relationships.

Clear and well-communicated financial boundaries reduce conflicts related to money, ensuring that all parties involved have a mutual understanding of financial limits and expectations. This transparency is essential for building trust and maintaining harmony in relationships, whether it’s with a partner, family member, friend, or colleague.

By enforcing financial boundaries consistently and overcoming challenges, individuals can enjoy the numerous benefits of financial stability, such as reduced stress, accumulated savings, and better financial decision-making. These benefits contribute to a secure and balanced financial future, allowing individuals to focus on their personal and professional growth.

Ultimately, the importance of financial boundaries cannot be overstated. They are a form of self-care that safeguards one’s financial well-being and promotes a secure and balanced financial future.

Recap: Key Points of the Article

- Understanding Financial Boundaries: Financial boundaries are limits and guidelines for managing finances in personal and professional settings.

- Why Financial Boundaries Matter: They prevent financial stress, enhance relationships, and ensure responsible financial management.

- Common Financial Boundaries in Personal Life: Include budgeting, limits on lending/borrowing, and discretionary spending.

- Setting Financial Boundaries in Relationships: Important for mutual understanding and reducing conflicts in romantic relationships, friendships, and family dynamics.

- Establishing Financial Limits in Professional Settings: Essential for separating personal and business expenses, adhering to budgets, and fair salary negotiations.

- The Role of Financial Boundaries in Preventing Debt: Through budgeting, setting discretionary spending limits, and responsible borrowing.

- Tips for Communicating Financial Boundaries: Be honest, use “I” statements, and set specific boundaries.

- How to Enforce Financial Boundaries Consistently: Regular monitoring, financial check-ins, and sticking to consequences of boundary breaches.

- Overcoming Challenges in Maintaining Financial Boundaries: Managing social pressures, handling unexpected expenses, and having honest conversations with loved ones.

- Long-Term Benefits of Setting Financial Boundaries: Accumulation of savings, reduction of financial stress, and promotion of financial discipline.

FAQ

Q1: What are financial boundaries?

A1: Financial boundaries are limits and guidelines individuals set regarding their financial matters, including spending, saving, and sharing finances with others.

Q2: Why are financial boundaries important in personal life?

A2: Financial boundaries help in maintaining financial health, preventing overspending, reducing conflicts, and ensuring financial stability.

Q3: How can financial boundaries prevent debt?

A3: By adhering to a budget, setting limits on discretionary spending, and establishing clear borrowing guidelines, financial boundaries can prevent unnecessary debt.

Q4: What are some common financial boundaries in relationships?

A4: Discussing financial goals, setting limits on shared expenses, and having transparent communication about financial expectations are common financial boundaries in relationships.

Q5: How can one communicate financial boundaries effectively?

A5: Use honest and transparent communication, utilize “I” statements, and be specific about financial limits to effectively communicate financial boundaries.

Q6: What are some challenges in maintaining financial boundaries?

A6: Temptation to overspend in social situations, handling unexpected expenses, and managing emotional relationships are common challenges in maintaining financial boundaries.

Q7: What are the benefits of setting financial boundaries in professional settings?

A7: Benefits include the clear separation of personal and business expenses, adherence to budgets, and fair salary negotiations, all of which contribute to ethical and responsible financial management.

Q8: How can one enforce financial boundaries consistently?

A8: Regular monitoring, financial check-ins, and adhering to the consequences of boundary breaches are effective ways to enforce financial boundaries consistently.